No matter how much money you make or how much you have in the bank, everybody needs a budget. Without one, you can’t track your money properly, and it’s easy to lose control of it. Imagine how you would feel if you could pay cash for gifts during the holidays, and have money available if your car breaks down.

If you set up your budget the right way, you’ll have money set aside for bills, gifts, savings, emergencies, and fun.

Who wouldn’t want that? Luckily, setting up a budget and sticking to it is easy to do.

Start a Spreadsheet

The first step to setting up a budget is to start a spreadsheet. You could write it out on paper, but changes and calculations are much faster and easier with a spreadsheet.

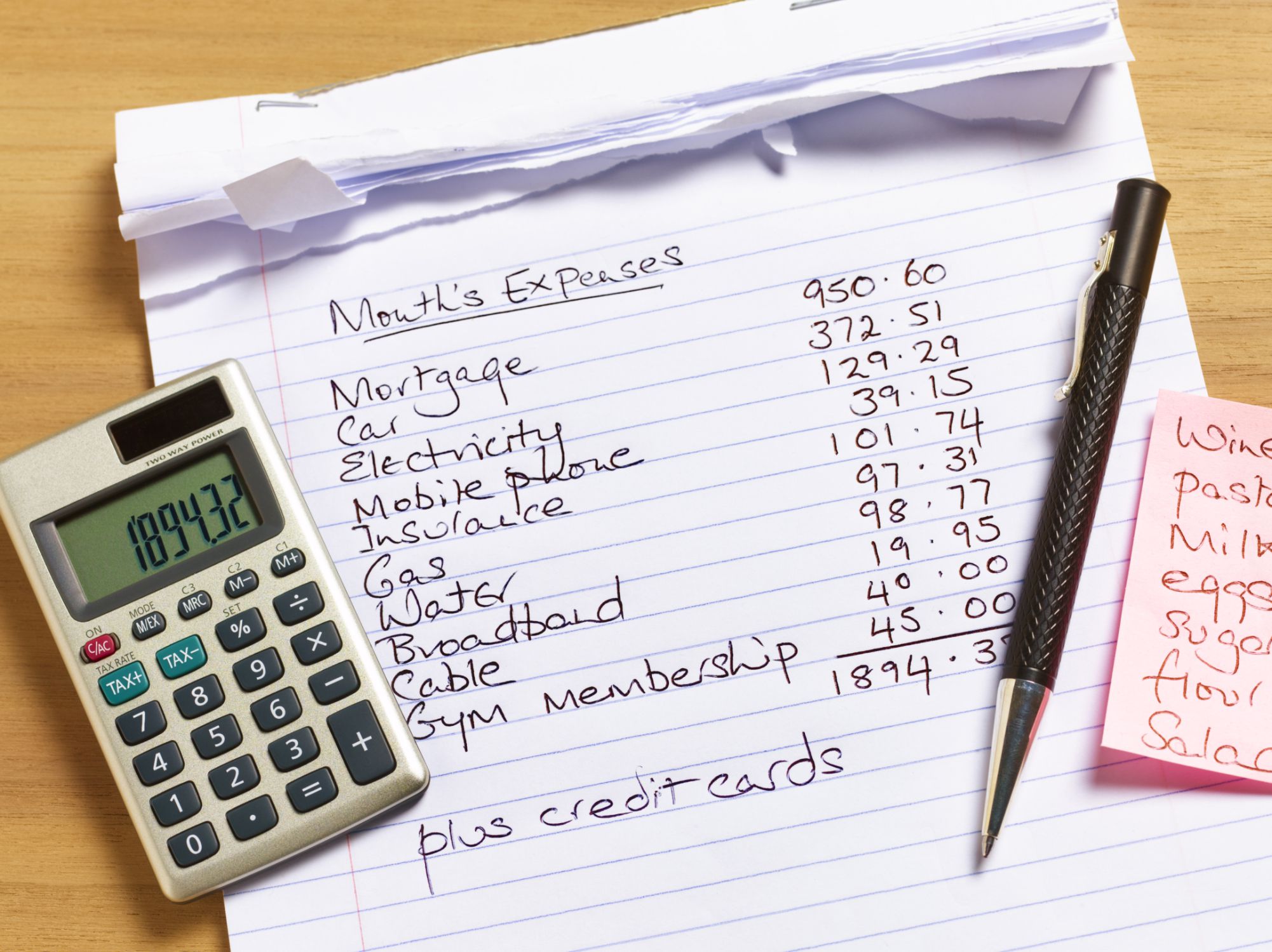

Next, put the date at the top of your sheet and make a row for income underneath. Skip a couple of lines down and list every expense you pay. Use a different row for each item, including rent, food, insurance, telephone, electricity, and credit cards.

Whether you have personal loans from banks in Jacksonville, TX, or mortgage payments in Omaha, NE, all debt needs its own line. Lumping them together could lead to forgetting to pay a bill, and your credit score won’t like that.

Expand your budget beyond your monthly bills by adding expense lines for holidays, car maintenance, savings, and anything else you pay for only once in a while.

Finally, label the next two columns “budget” and “actual” because that’s where you’ll input your dollar amounts.

Gather Your Numbers

In the budget column of your spreadsheet, go down each row and input dollar amounts. For your income, add all the money you make in one month, and input the number next to “income.” Next, list all the amounts you pay for your expenses for the month next to their label.

When you have the numbers in your spreadsheet, total them at the bottom by taking your income and subtracting your expenses. The bottom line should equal zero. If the total number isn’t zero, tweak your budget until your income equals your expenses.

Track Your Bottom Line

Once you have your budget set, it’s time to put it to good use and track your spending. For tracking, you want to use the column you labeled “actual.” Every time you get paid or pay a bill, enter the amount on the corresponding line in the “actual” column.

Set up a total at the bottom of that column as well, and be sure it always equals zero.

A Budget Frees Up Your Money

As you can see, setting up and tracking your budget is simple, and it will give you a handle on where you spend your hard-earned cash. But keep in mind that your budget can change and it should. If something isn’t working in your budget, adjust it until it works for your life.

Budgeting allows you to consciously choose where your money goes instead of guessing where it all went.